Essay about Fair Tax: Avoidance of Taxes. PA - “Fair Tax” Policy Analysis John Maynard Keynes stated that “the avoidance of taxes is the only intellectual pursuit that carries any reward,” (Waters, ). In Missouri, while seeking to avoid an income tax, advocates for the “Fair Tax” have seemingly presented a proposal that is the antithesis of the pursuit Keynes deems worthy Jul 17, · Tax is to impose a financial charge or other levy upon a taxpayer (an individual or legal entity) by a state or the functional equivalent of a state such that failure to pay is punishable by law. A tax may also be defined as a "pecuniary burden laid upon individuals or property owners to support the government, A payment exacted by legislative authority." Essay on Taxes. Words5 Pages. The federal and state governments provide the American citizens with all of the basic necessities within our communities and society that is taken for granted. Programs responsible for assistance in times of need, providing a quality standard of living, and maintaining the strongest military in the world costs incomprehensible amounts of money and could never exist without taxes

Essay on Taxes - Words | Bartleby

we want in detail about new taxes that have been come and ther rate in and and there rates of payers of that taxes. Jul 17, Total- Word. Meaning of Tax:. The word tax came from the Latin word taxo which means- "I estimate", essay on payment of tax. Tax is to impose a financial charge or other levy upon a taxpayer an individual or legal entity by a state or the functional equivalent of a state such that failure to pay is punishable by law.

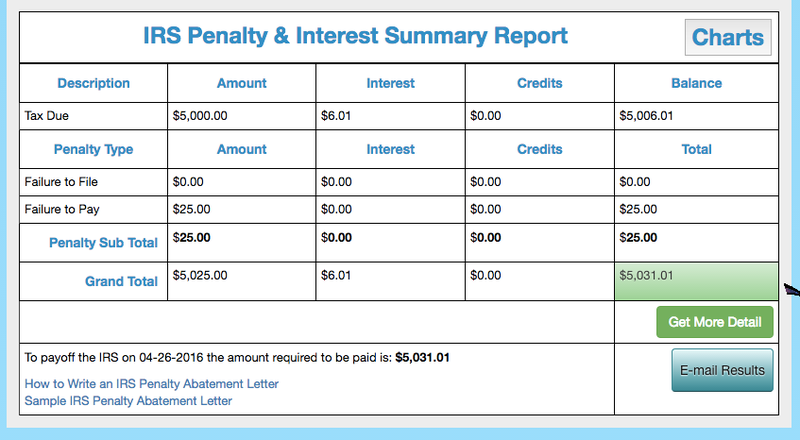

A tax may also be defined as a "pecuniary burden laid upon individuals or property owners to support the governmentA payment exacted by legislative authority. The legal definition and the economic definition of taxes differ in that economists do not consider many transfers to governments to be taxes. In modern taxation systems, taxes are levied in money. Tax collection is performed by a government agency such as Canada Revenue Agency in Canada, the Internal Revenue Service IRS in the United States, or Her Majesty's Revenue and Customs HMRC in the UK and Incometax Department in India.

Very high or low income tax does not necessarily mean to aid economy of any country. I would like to support my views on this topic in following paragraphs. First, income tax is a key driver for any country to grow and provide sufficient facilities to its citizens.

For example without having police in the society it is almost impossible to protect citizens and provide necessary security for the industries from stealing their products.

In absence of police, various industries will have to hire their own security, which will negatively impact on the industries performance since they have to spend lot of money on the security, essay on payment of tax. Same thing with the army; in absence of army it is impossible to protect the people from outside enemies in case of war or terror attacks.

Thus in order to have smooth functioning of all the systems mentioned above essay on payment of tax must of some income tax posed on countries citizens all over the world. However, imposing higher taxes does not necessarily mean strong economic growth.

In this situation, the government may not be able to fund key systems as described above. Also, government will not have sufficient money to build infrastructure, transportation systems required for the people.

Tax Classification:. Consumption tax can be classified into indirect tax levied on consumption. Indirect tax depending on whether the consumer is limited to certain taxable goods and services can also be divided into separate tax and general excise tax.

Consumption tax is levied on individual or group of specific goods, and the items subject to taxation are not uniform in a particular tax rate. This taxation method applies classifications on different levels, and considers tax on the grounds of importance, items such as alcohol and tobacco products have deterrent taxes imposed on them sin tax.

While, basic food related products are treated as essential, thus do not entail heavy taxation. The primary principle of consumption tax pertains to the power of deferral. Criticism levelled at sales and consumption taxes is based on the argument that the two tend to transfer the essay on payment of tax burden to the low income earners.

Consumption tax, essay on payment of tax, a kind of indirect tax was invented by Maurice Laure essay on payment of tax the French finance ministry.

A mechanism that focuses on trade of goods and services arising in the Value-Added Tax, VAT, or GST Goods and Services Tax, Excise Duty, essay on payment of tax. General consumption tax can be divided into value-added tax and consumption type VAT by the method of calculating income-type VAT. The former is calculated at the time of deduction of capital goods, suppliers are not allowed depreciation; the latter is fully deductible and for capital goods, only a fraction of taxable consumption.

General excise tax and individual tax are somewhat similar, the general excise tax is also an element of criticism, and is associated with the alternative tax, such as direct income tax and corporation tax. The general consumption tax for luxury goods was once considered a form of excise tax imposed on individual goods. A number of economists and tax experts prefer consumption taxes as compared to income taxes for economic growth.

Consumption taxes tend to be indifferent in relation to investment. Based on execution and existing conditions, income taxes can either promote or disfavor investment, essay on payment of tax. In the main, national tax systems are considered to discourage investment and the consumption tax could contribute to boosting the capital stock, productivity, and the economy. General Consumption Tax general expenditure tax is the method proposed by British economist Nicholas Kaldor.

Originally conceived as a tax to supplement the income tax by collecting taxes in the form of tax expenditure from income and capital gains, interest rates and savings. Examples for direct taxes are taxes on net worth, income taxes, death duties, and gift taxes.

Indirect taxes are essay on payment of tax which are not charged on and collected from those who are intended to accept it. These taxes will not take individual consider circumstances. Examples for indirect taxes include excise taxes, essay on payment of tax, sales taxes, and value-added taxes. Taxes can also be categorized based on their effect on the distribution of wealth.

This classification includes proportional taxes, progressive taxes and regressive taxes. A proportional tax is one in which the burden of tax imposes equally on all taxpayers, unlike progressive taxes and regressive taxes.

In a essay on payment of tax tax the rate of tax will increases as your earning increases. That means individuals who earn more incomes have to pay greater proportion of their incomes as the tax. In a regressive tax the rate of tax will be high if your earning is less. Sales tax is often called as regressive taxes so as to make them compare feebly with income tax in terms of their fairness.

Sales tax is tied to consumption rather than income. So that individuals and families having low-income should pay a greater proportion of their incomes as sales taxes.

So we can say that sales tax is regressive which is unfair. Where Tax Expenditure go:. It is of importance to note that taxes in the society are spent on the following government functions:.

The United States taxation involves regular payments to 4 major levels of the US government:. local government including municipal, essay on payment of tax, district, county, essay on payment of tax. This government is financed by property taxes permits, fees, parcel taxes, fines, income tax, gross payroll, sales tax, etc.

Azra Ahmadis the founder of Creative Essay and Creative Akademy You can follow him on Facebook Page. Email This BlogThis! Share to Twitter Share to Facebook. Labels: Income tax. Anonymous April 11, at PM, essay on payment of tax. Edit your Comment. Newer Essay Older Essay Home. Subscribe to: Post Comments Atom. Weekly Popular 20 lines 'My Home' Essay for Class 12 Pointwise. I feel fully safe and secure in my home. My home i How do You Help Your Parents at Home Essay for Class 3. I feel proud of any help to my parents.

In the morning I get ready myself for school. I keep books in school bag for day routine. A letter to the Editor of a newspaper For Frequent Power Cuts. Today's transmissio Essay on 'My Aim to Become an IPS Officer'. It is said that "In order to fulfill your dreams you need to wake up". Having an aim or a goal in your life is very important be My Essay on payment of tax Routine Essay For Kids Point Wise Daily Routine Paragraph.

For writing essay or paragraph on daily routinefirst it needs to 'workout a plan' for 'daily routines for kids'. It is Essay on 'My visit to a Park' For Class 4, essay on payment of tax. Park is a place where we can enjoy and have a good time with our family and friends.

I visited a park with my family in the month of sprin Search by one word. Essay Forum Creative Academy Publish Your Essay Letters Member Submission Contact Me About Contents FAQ. Important Links Submit Eessay topic! Letter and Application! Hindi Essay! Report Error! Essay Categories!

Subject wise! Class wise! Categories of Essay Informative essay Aim of Life Biography Essay school Hindu Festival Essay Competitor Autobiography Essay my favourite Essay On Pollution my dream Health is Wealth Lokpal bill Essay hindi essay How to write essay tricks My School Science essay behaviour my mother A trip with your Family Most memorable day in my life.

bird essay topics essay words internet leisure picnic poverty quotation sea beach short essay sign of humanity students worksheet Acid Rain Drug Abuse Effective English Essay English Expression Gram Panchayat essay Hill Station Journey By Train Hindi Jubilee Jayanti Luck My Favourite Cartoon My Introduction Neighbour Photos Images Pre-Historic Times Rising in price in India School Magazine Teachers day Time birthday boating co-deducation handicapped lotus flower my wish no pain no gain paypal police population rash driving school bag solo player tree upto Words words youth generation.

What is tax - Taxation explained

, time: 3:46Essay on taxation system | Essay about Tax

Essay on Government Taxation. Words7 Pages. There are two things in life that are certain: death and taxes. In today's world, the majority of our government's income comes from taxation. A tax is not a voluntary payment or donation, but an enforced contribution imposed by government (Mikesell, ). Taxes are an amount of money collected from citizens, and they are used to provide public goods and - 97 - an essay on the effects of taxation on the corPorate financiaL PoLicy DeAngelo and Masulis () explain, one can make the case of a tax shield substitution effect since the avail-ability of nondebt tax shields may crowd out debt tax The regressive tax is whereby the income of an individual goes up, and the tax to pay decreases, while as in the progressive blogger.comlment Payment Options: Short Term Extension, Installment Plan Agreement, Offer in blogger.com: A humorous essay seeks to describe how taxes work in the context of ten men splitting a dinner check.A tax is not a voluntary payment or donation, but an /10()

No comments:

Post a Comment